Customer feedback is all about getting answers. For that you need questions to ask. There are many types of survey questions employed for different scenarios and purposes. Here we explore the 10 best kinds of survey questions, as well as how and when to use them.

Why are there so many different types of survey questions?

Questions are central to human communication. They invite information to be found truthfully and voluntarily. Being asked a question causes you to think and consider your response.

Different types of survey question for different types of information

Why are there so many types of survey questions? Because there are lots of kinds of information you might want to uncover. Having a variety of ways to elicit information is like having a variety of tools to ‘pick’ a lock. As we’ll see from some of our examples, it’s good practice to select certain types of survey questions when you want certain kinds of information.

Different types of survey question for different amounts of detail

It’s a similar story with the depth and detail your information needs to go into. For example, is it more important to get a definitive yes or no answer, or to explore the ranges of affirmative and negative? Depending on the requirement, a different type of survey question could be warranted in each case.

Different types of survey question depending on how much time and effort the respondent has

It’s very important to acknowledge that surveys consume a certain amount of time and effort. That takes a small but objectively meaningful commitment on the part of the survey respondent. If there’s reason to suspect they will engage better, and continue going through multiple questions, if questions are simpler and shorter – that can be reason enough to opt for certain types of survey questions.

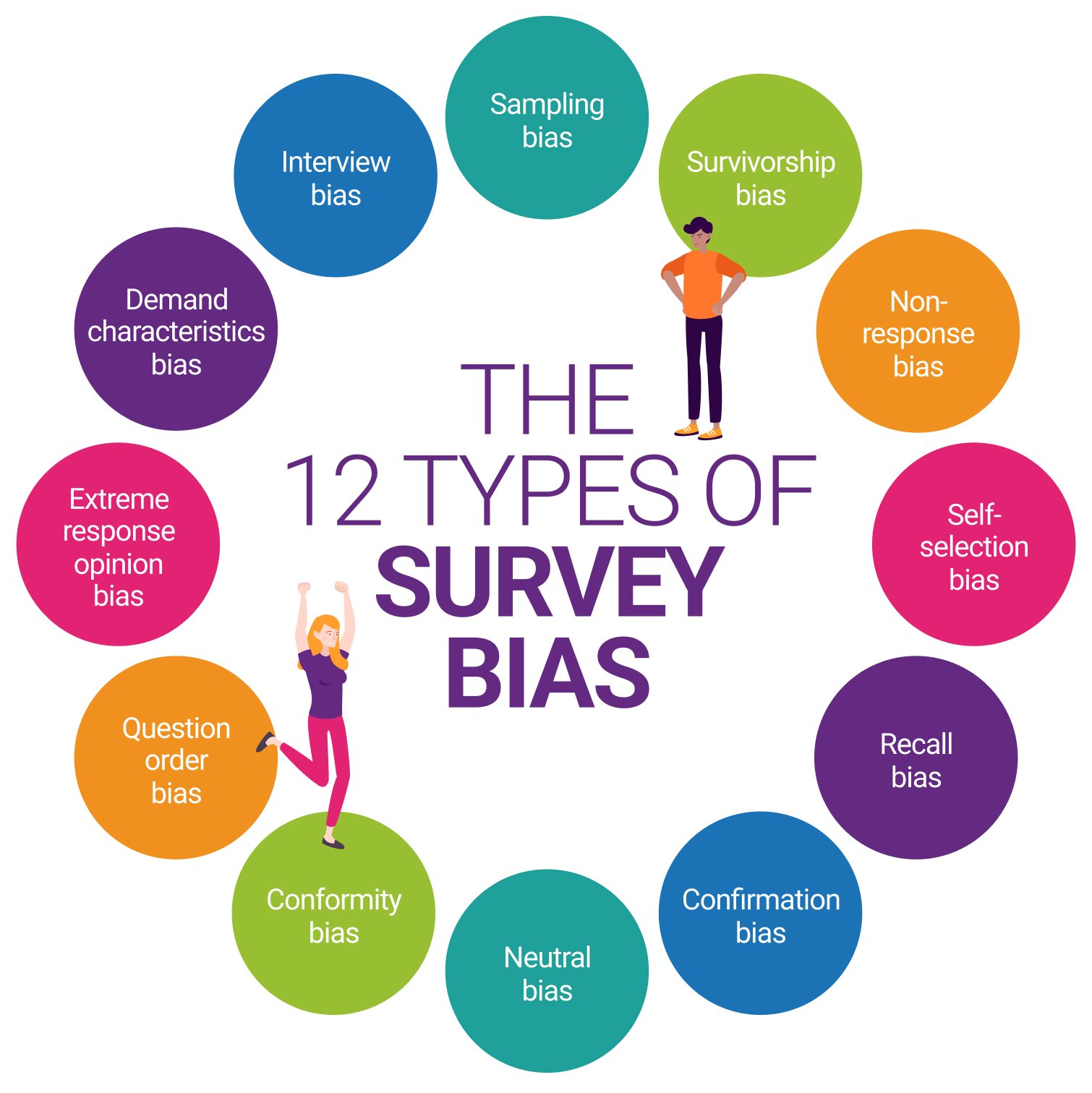

Different types of survey question to mitigate bias

Survey bias happens when the kinds of question you ask – and how to ask them – produce a biased result. This influences the choice of question type just as much as how questions are worded. No types of survey questions are biased in themselves; it’s just how they are applied. There are lots of kinds of survey bias – find out more here.

Different types of survey question to maximize engagement

Sometimes, the most important thing is getting the biggest possible response to your survey question. That can mean prioritizing an approach that utilizes some types of survey questions more than others. For example, those that are shorter, simpler or use more graphical elements. Often we see great customer surveys mixing up different types of survey questions just for the sake of variety and to keep things interesting for the participant.

![]()

10 types of survey questions you should use

When researching the different kinds of survey questions out there, it’s important to stay focused on the mechanics rather than the content. In our definitive list of question types, we’ve steered clear of things like:

- The kinds of data that questions are trying to uncover

- E.g. demographics, firmographics, etc.

- The kinds of graphical presentation of questions

- E.g. picture-based response options, iconography, etc.

- The kinds of audience that questions are targeting

- E.g. customer surveys, employee surveys, etc.

If you wanted to include these, the list would be way longer than just 10. But it would also be a distracting mish-mash which doesn’t help anybody.

Instead, the following 10 types of survey questions provide a framework for choosing which go best with your objectives.

- Open-ended questions

- Nominal (multiple choice) questions

- Dichotomous questions

- Likert scale questions

- Rating scale questions

- Contextual follow-up questions

- Matrix questions

- Drop-down questions

- Ranking questions

- Checkbox questions

Open-ended questions

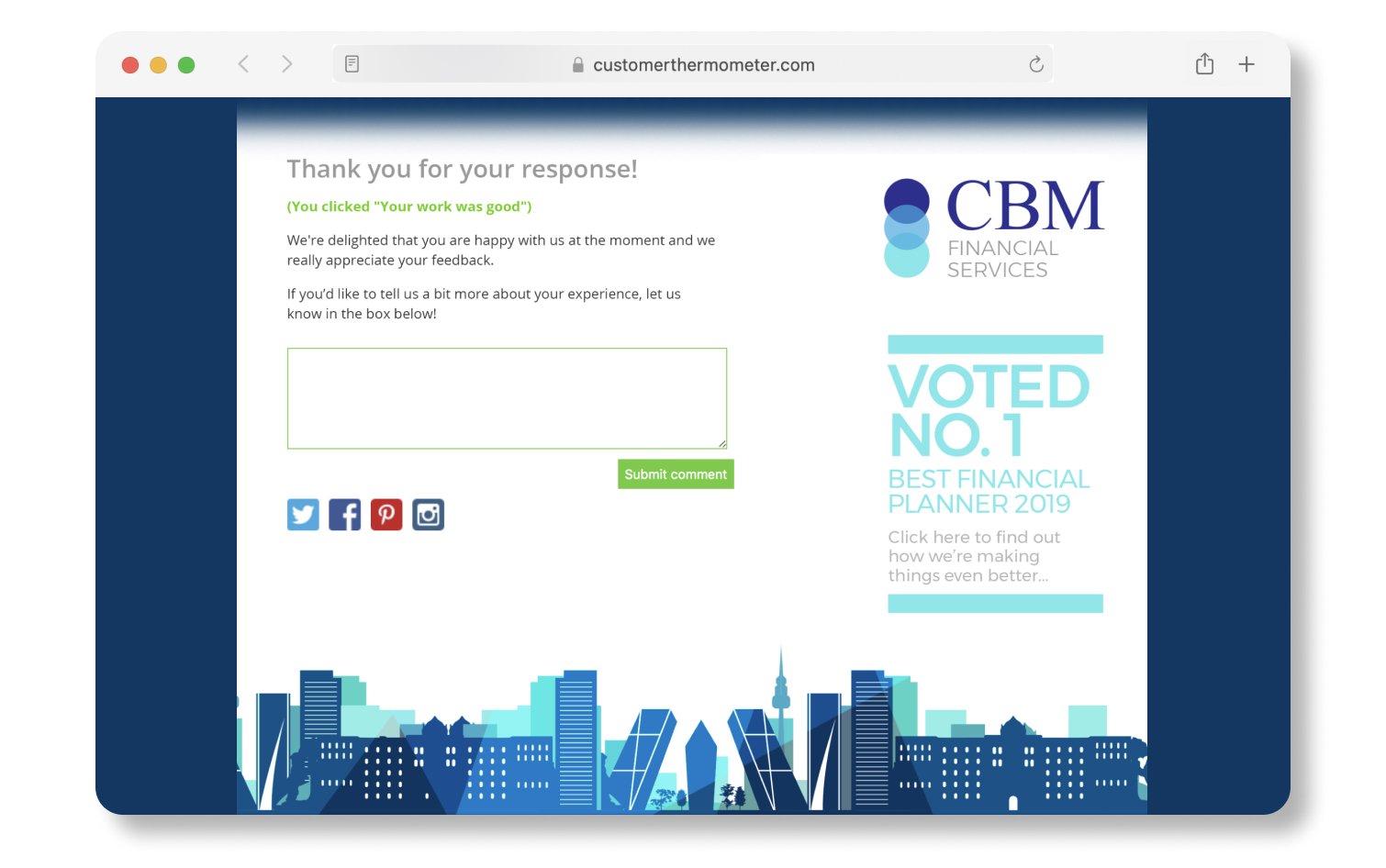

Open-ended survey questions are unique in our list of 10 as the only type without any preset answer fields. The whole idea is that respondents can articulate any answer they choose. This is typically facilitated by a free-text box where the answer/comments can be typed out.

The strength of open-ended questions is the richness of qualitative insights. But the resulting surfeit of unstructured data can also produce a significant data processing burden.

PROS: Rich insights

Scope to collect unexpected findings

CONS: Time and effort for respondents to complete

Time and effort for data analysis

Nominal or multiple choice questions

Multiple choice questions are usually similar to open-ended questions but with preset options to choose from rather than a free-text box. This takes less effort and makes them faster to complete. They can be tricky to get right, because of the risk of introducing survey bias. It’s all about the response options you set and whether these overlap or – worse – don’t cater for an appropriate range of answers. Typically a multiple choice question will include an “Other, please specify…” answer option to enable all eventualities to be satisfied. This is, in effect, makes the question open-ended for the purposes of that particular response option.

PROS: Saves time and effort for respondents and in the analysis process

Helps narrow down lots of possible answers into smaller groups

CONS: Care must be taken to avoid introducing bias

Including the “Other” option creates a need for unstructured, qualitative data to be analyzed

Dichotomous questions

A dichotomous question is just a fancy term for a question with two possible responses. Most of the time these will be yes/no but could stretch to any question with only two possible outcomes. For example, if the organization has only two stores, the question could be “which of our stores did you visit”. This makes it the perfect question type for such instances. It’s also extremely easy for respondents to understand and select from.

Even though dichotomous questions are really simple to understand, there is plenty of scope for misuse. The biggest issue is context. The question about “which of our two stores did you visit” only qualifies as dichotomous if the respondent definitely visited one of the stores. If you’re asking people who may or may not have visited either, you need to include options like “neither”. Likewise, sometimes even a ‘yes/no’ question may be made non-dichotomous with the addition of a third option: “don’t know”.

PROS: Super simple and fast

Good for screening responses into cohorts that you can target supplemental questions to

CONS: Limits findings and gives limited insight

Cannot be used to detect nuance

Likert scale questions

Likert scale questions allow respondents to record their intensity of opinion. Typically, respondents choose from a scale of 5 or 7 answers with extremes at either end. For example, if asked how important something is to them, the options could be “very important”, “somewhat important”, “neither important nor unimportant”, “somewhat unimportant” and “very unimportant”. The range of applications for this question are not exhaustive. However, as well as “importance”, Likert scale questions are also often used to capture opinions on satisfaction, quality, frequency, likelihood and more.

PROS: Simple to engage with and analyze

Can capture nuances in opinion where questions are not clear-cut

CONS: Can encourage ‘neutrality bias’ and allow respondents to sit on the fence

Options like “somewhat unimportant” and “slight dissatisfied” can seem meaningless

Rating scale questions

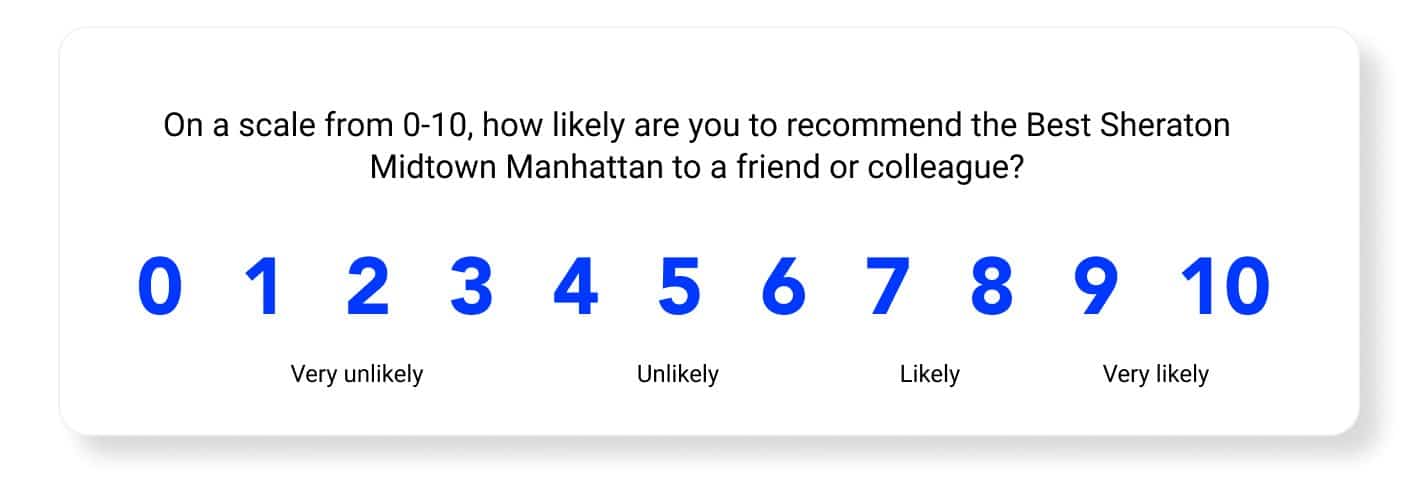

Rating scale questions (or scale questions) provide respondents with a numeric scale with which to ‘rate’ their answer. Accordingly, scale questions are phrased with “on a scale of 0–10…” at the beginning. The scale is invariably 10, though occasionally 5 is also used. Popular CSAT surveys use the 10 approach, as does Net Promoter Score® (NPS) – probably the most commonly used customer feedback metric of them all.

Rating scale questions are easy to analyze and simple to complete. However, you have to apply some assumptions as to what the different numbers mean to respondents in order to make sense of the results. The fact that respondents can only use numbers presents a great deal of subjectivity. For some, an 8 will be a very high score, but for others it’s only what the customer expects, or perhaps even less than they expect. Likewise, some customers would put 5 to mean everything was OK and satisfactory, while for others it would be a terrible score.

PROS: Simple to use and draw conclusions from

Ideal for tracking change over time using the same survey question

CONS: Doesn’t uncover why customers give certain ratings

Respondents differ in what the numbers mean, potentially skewing results

Follow-up questions

Follow-up questions are great for filling-in and fixing deficiencies in earlier survey questions. For example, as with rating scale questions above, pairing up with a follow-up question that asks why respondents gave a particular score. These are called filter questions or contingency questions are they’re very valuable in providing the necessary additional insight to correlate richer findings. When using any kind of follow-up question, however, you need to factor in the additional time it takes to conduct the analysis. Also, there’s no guarantee that – having given their score – participants will invest the time and effort substantiating it.

PROS: Finds out why respondents give certain answers, uncovering more meaning

Provides rich new insights you previously didn’t know

CONS: Can only be deployed in the context of an earlier or paired question

May irritate respondents and cause them to abandon, leading to complete findings, and adds extra analysis workload

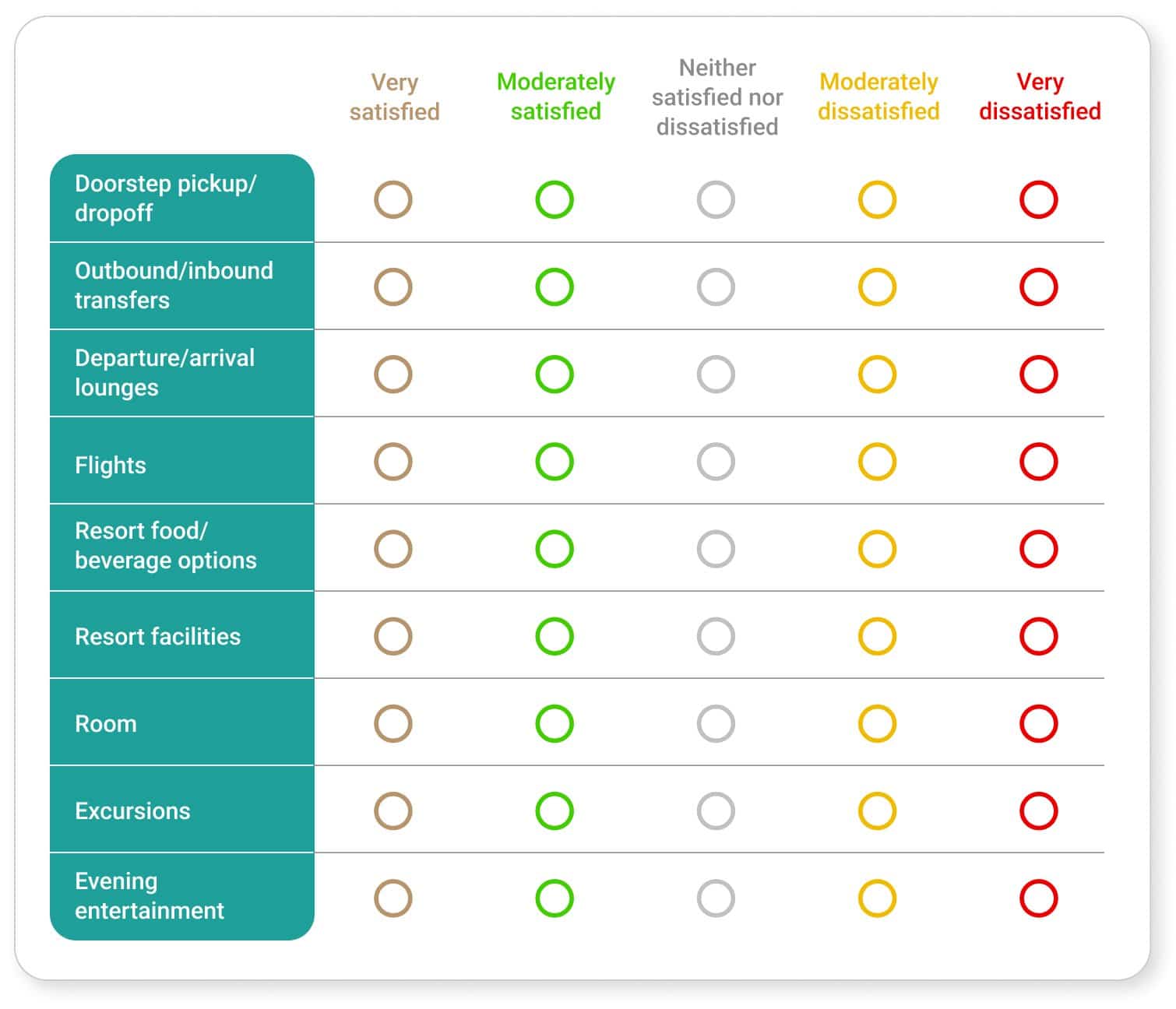

Matrix questions

Going through a succession of questions can be quite fatiguing for respondents. And when survey fatigue sets in, response rates go down. One way to avoid this is by using matrix questions to truncate the question-answer-question-answer monotony. It works best with a series of scale-based questions, such as Likert or rating. These can then be compressed into a matrix rather than having them broken up one at a time.

The limitation with this approach is ensuring the questions relate to each other in some way. For example, asking about how a customer felt about their hotel stay. This could include 4 or 5 questions on the same scale, but each asking about a different facet such as check-in, hotel amenities, room cleanliness, onsite bar/restaurant and check-out.

PROS: Makes longer surveys feel less painful and time consuming

Simplifies a lot of content into digestible process

CONS: Only works with questions that are closely related to one another

If too large, can become confusing and impenetrable

Drop-down questions

Drop-down questions are a must for those categorical types of survey questions where there is an exhaustive list of possible options. Classic examples include “which country are you from” and “what year were you born”. The temptation here is often to treat the question as open-ended and leave a free-text box to be completed – unnecessarily adding admin burden to sift through it all. Similarly, having a multiple-choice list of options that’s either unbelievably long or grouped into imprecise segments (e.g. selecting continent first, then country – or choosing a birth date by decade first, and then year). Instead, a drop-down selector can be used to scroll or search for the appropriate answer.

Sometimes, organizations choose to use segments in their drop-downs, rather than show the full list. This can speed things up, but also reveal some of the context for the question, which can actually be a cause of survey bias. For example, as a 44 year-old, being presented with age categories that went 0-8, 9-14, 15-20 and 21+ could subconsciously make you react differently about remaining questions, than if they went 18-29, 30-49, 50-69, 70+.

PROS: Great for questions where the list of possible options is logical and very long

Quick and easy for respondents and analysts

CONS: Could, in certain circumstances, create survey bias

Only really applicable to a narrow range of scenarios

Ranking questions

Ranking questions (also called ordinal questions) can extract really useful insights in a way that doesn’t pile up unstructured data for analysis. They work by asking respondents to rank answer options into order or preference or prominence. For example, rank the following detergent brands in order of value for money. This encourages respondents to think and be more discriminating than with other sorts of questions than have been designed to make things fast and simple.

Another important consideration when using ranking questions is how much respondents know about each of the things they are being asked to rank. In the example above, the question doesn’t work if the respondent isn’t responsible for purchasing household items in their home. Or if they are very familiar with Tide and Arm & Hammer but have barely even heard of Persil.

PROS: Forces respondents to identify their preferences and prejudices thoughtfully

Enables rich insights without the corresponding analysis overhead

CONS: Relies on respondents to know enough about the things they’re ranking

Having to think hard takes time and effort, which may lead some to skip the question or abandon the survey

Checkbox questions

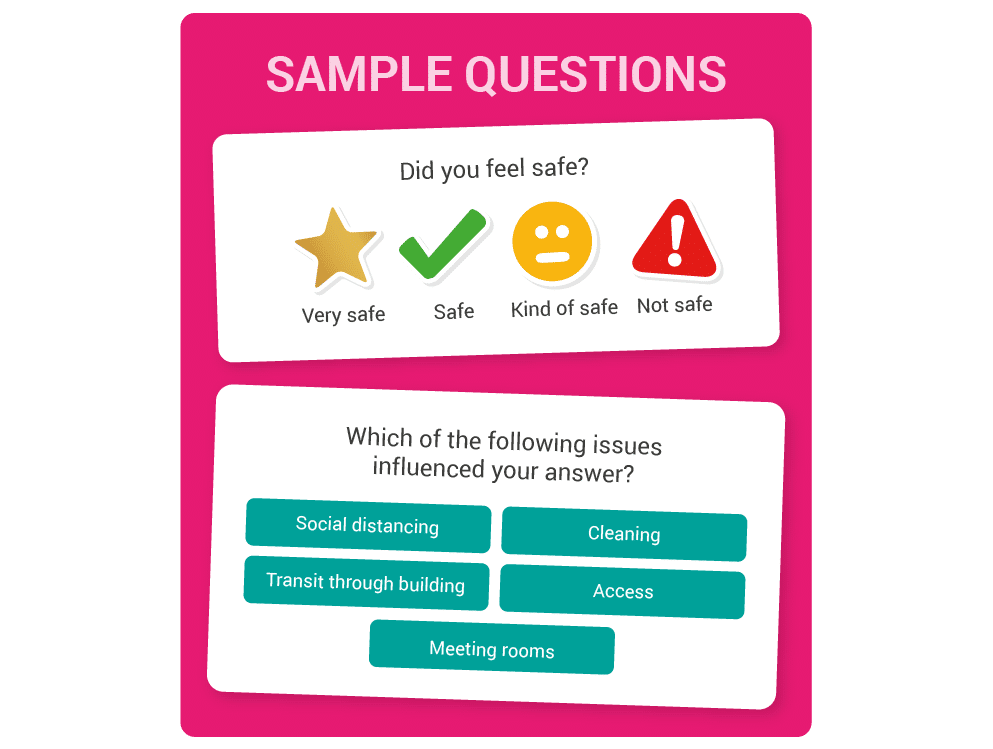

Checkbox questions (also called tick-box questions or select-all-that-apply questions) provide multiple choice answer options where respondents can check all that apply. This subtle difference to the standard multiple choice question design actually makes a profound difference to the kind of data collected and how it’s analyzed.

Checkbox questions work best when collecting evidential data rather than subjective opinion. For example, an amusement park might ask “which of the following rides and attractions did you experience” and then list all or some of those available. By seeing which have been selected, filter/contingency questions can follow up to zero-in on richer insights. Checkbox questions need to be carefully constructed so that the results make sense. Sometimes forcing a definitive answer works better than allowing multiple options to be selected. For example, asking how satisfied a customer is with the service they received (using multiple choice options) demands a single response.

PROS: Great for collecting evidential data

Fast and simple for respondents to interact with

CONS: Can lead to confused or nonsensical findings

Open to unintentional bias, particularly if options list is not comprehensive

How to ask good survey questions

Later on we have a section on how to write survey questions the best way. Here we’re looking at the optimum way of getting your survey questions organized. Follow these 7 top tips:

Know what you want to find out

First up is defining the purpose of your survey question. Why are you doing this? What’s the goal? What will you learn? How will you use the data? The answers to these questions should influence your choice of question type and other factors.

Ask the right people

Next is defining your audience. Are you targeting the right people? How will you reach them? What do you know about their communications preferences for conducting a survey?

Think about results analysis beforehand

Don’t make the mistake of dreaming up great survey questions before you’ve fathomed how you’ll analyze the results. Are you benchmarking the data? How will the data be reported on, interpreted and communicated? Have you factored in resources to review and categorize any unstructured qualitative data?

Have a response plan in place (if dealing with known customers or employees)

Asking questions can be a trigger for all kinds of feedback, especially if you’re sampling customers or employees. If you’re directly enquiring after customer satisfaction, for example, be ready to respond to any negative feedback this could provoke. Take the time to respond personally and escalate any issues so they are resolved rapidly. At the very least, thank respondents for taking part.

Make it fast, easy and low effort

The key here is being brief. You want people to complete the survey and not abandon it. Keep surveys short with the minimum number of questions in a survey overall. Individual questions should be as concise as possible – choosing certain types of questions can help with this.

Get your timing right

Timing is very important, particularly with a view to context. Want to ask new customers how their first experience of your product went? Be sure to ask them straight after they’ve used it. It’s amazing how often organizations seem unable to see the world through their customers’ eyes and appreciate the context in which surveys are received. There are also some worthwhile tips on times of day and days of week that seem to work best for getting a good response rate with email surveys.

Test, test and test again

Your survey is unique to you, your audience and your objectives. That means there is no magic recipe anyone else can tell you. That’s where testing comes in. Testing helps refine the questions you’re asking as well as how you’re asking them. It can also iron-out any technical issues with survey distribution.

Most commonly used types of survey questions

Of the survey question types we’ve covered in this guide, some are more popular than others. Let’s look at which ones get used the most and why…

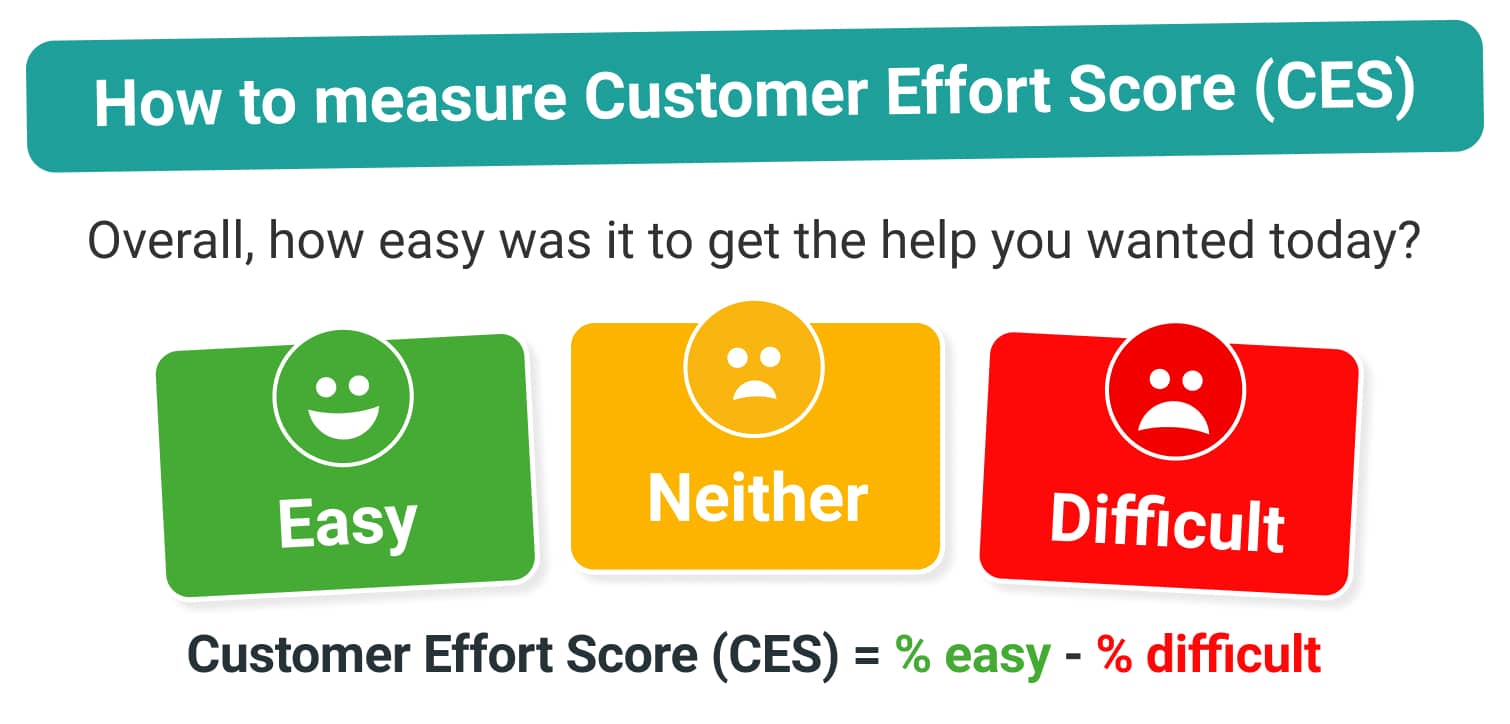

Metrics like NPS and CSAT run off rating scale questions

Rating scale questions are central to some of the most commonly used customer feedback metrics. This includes Net Promoter Score (NPS), Customer Satisfaction Score (CSAT) and Customer Effort Score (CES). This puts rating scale questions near the top of the list in our view.

Multiple choice questions are everywhere

No list of super-popular types of survey question would be complete without multiple choice. It’s how most people expect surveys to run because these question types are everywhere, from school exams to market research.

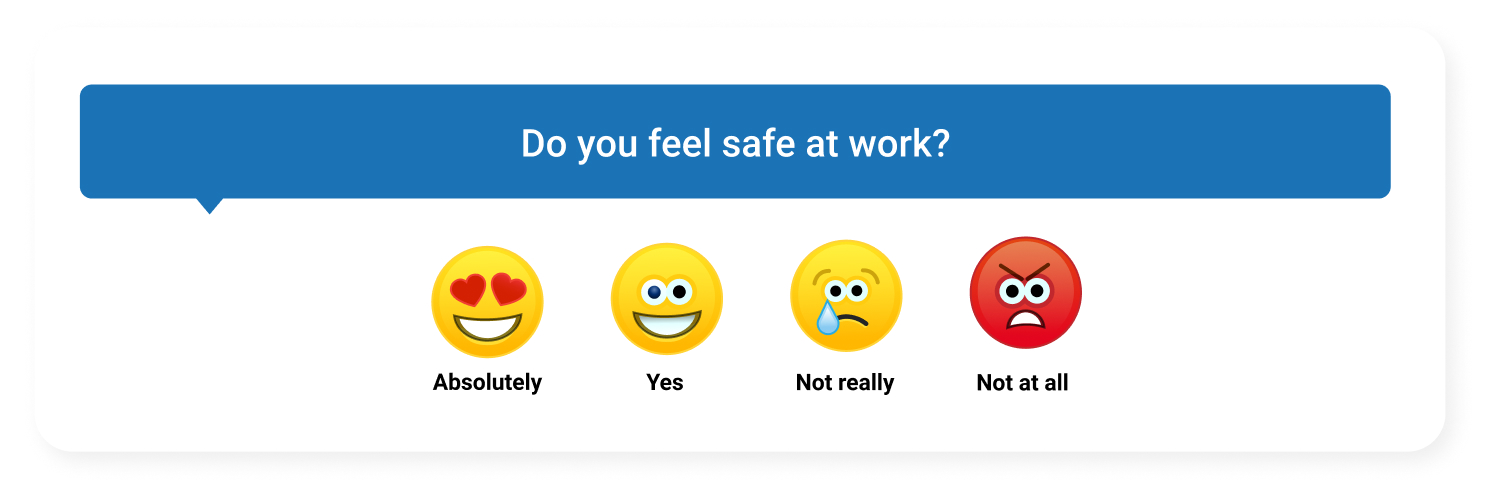

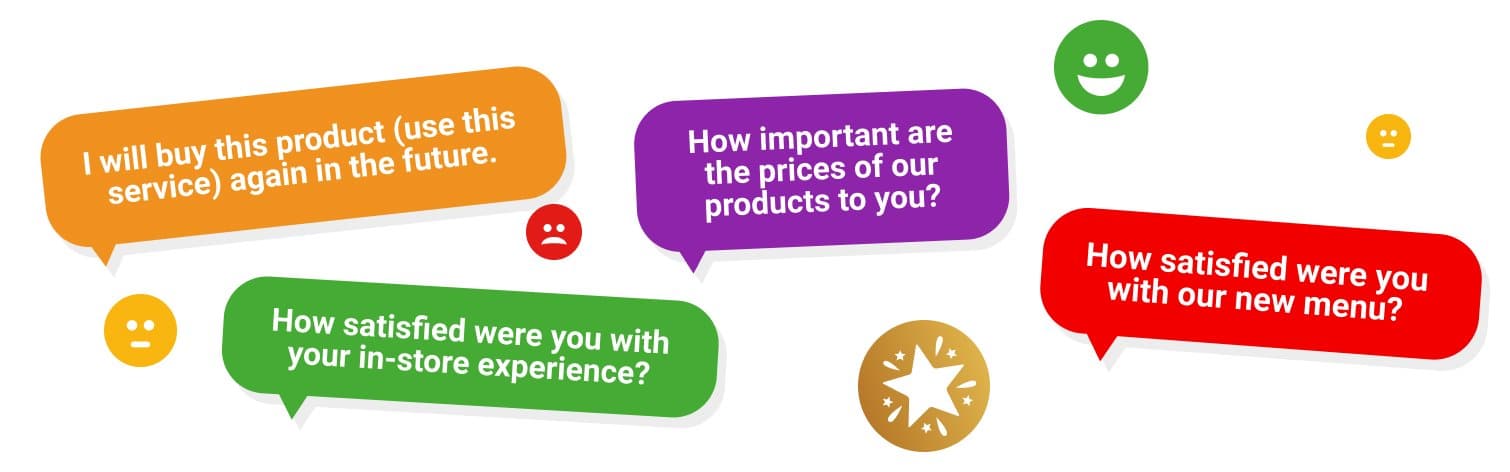

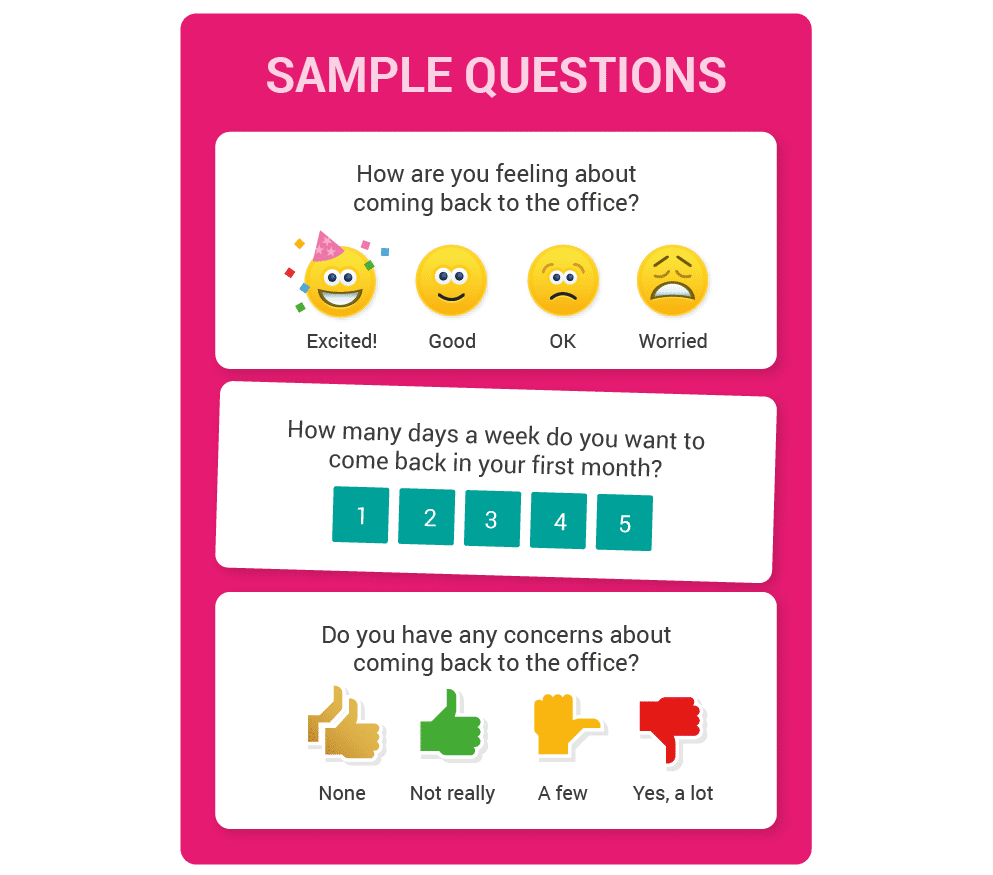

1-click survey questions are being the norm for customer feedback

Several survey question types support the concept of the 1-click survey. This is where audiences receive a single question that needs just a single click to complete. This could be a Likert scale question – ideally with the options rendered as branded or emoji-based icons – a rating scale question or, most simply of all, a dichotomous question.

Our own research found that one-click, one-question surveys are popular among respondents too, because it saves time and hassle. 64% either love or like the idea of responding to these kinds of surveys.

When to use which survey question types

So which of the types of survey questions we’ve identified should you adopt? Well, it depends… Here are some ideas on which scenarios to use each of them for.

Best for optimizing response rate

- Dichotomous questions

- Likert scale questions

- Rating scale questions

Best for faster completion

- Nominal (multiple choice) questions

- Matrix questions

- Checkbox questions

Best for easy analysis

- Dichotomous questions

- Likert scale questions

- Rating scale questions

- Drop-down questions

Best for mitigating survey bias

- Dichotomous questions

Best for rich insights

- Open-ended questions

- Contextual follow-up questions

Best for tracking metrics over time

- Likert scale questions

- Rating scale questions

- Ranking questions

Best for getting respondents off the fence

- Ranking questions

10 survey question examples

We’ve identified 10 types of survey questions. Here’s an example for each…

Open-ended survey question example

How would you describe your experience with us today?

- Please type here

Nominal (multiple choice) question example

How often do you watch feature-length movies?

- Daily

- Weekly

- Monthly

- Quarterly

- Annually

- Other (please specify)

Dichotomous question example

Have you ever visited one of our stores?

- Yes

- No

Likert scale question example

The online store checkout process was straightforward.

- Strongly agree

- Moderately agree

- Neither agree nor disagree

- Moderately disagree

- Strongly disagree

Rating scale question example

On a scale of 0–10, how likely are you to recommend the Best Sheraton Midtown Manhattan to a friend or colleague?

- 0–10 rating scale

Contextual follow-up question example

Based on your rating of X out of 10, what areas could we improve on to receive a higher rating from you in future?

- Please type here

Matrix question example

How satisfied or dissatisfied were you with the following aspects of your trip?

Drop-down question example

Which country do you reside in?

- Alphabetized dropdown of 195 country options

Ranking question example

Please rank the following in order of the importance to you when buying a car

- Price

- Reliability

- Gas mileage

- Brand

- Finance options

- Curb appeal

- Dealer recommendation

- Other, please specify

Checkbox question example

Which of the following Ben & Jerry ice cream flavors have you tried in the last year? Tick all that apply.

- Phish Food

- Minter Wonderland

- Netflix & Chill’d

- Cookie Dough

- Caramel Chew Chew

- Chunky Monkey

Tips for writing survey questions

Care should always be taken when writing survey questions. This is because question wording informs how the answers can be used and relied upon for decision making.

Another reason is simply to ensure that whoever is answering the question understands what is required of them. This ensures the results are worth using, and that the respondent will bother participating in the first place.

Last but not least, the way you ask questions also has a big influence on whether the findings can be deemed trustworthy or otherwise tainted by bias.

Consider the following tips for writing survey questions:

- Understand that respondents want to spend the minimum amount of time and effort answering your questions. Help by minimizing their required thinking.

- Use words rather than numbers in survey response options.

- Ensure questions and response options are as short as possible. And use as few of them as possible. Ideally just one.

- Be clear and specific. Avoid overcomplicating the question or using jargon.

- Explore one simple idea at a time. Avoid so-called ‘double-barreled’ questions that try to ask two questions in one.

- Remove any potential for misinterpretation and ambiguity. Don’t use loaded questions.

- Ask ‘straight’ questions that don’t lead the respondent to conclusions. This will help avoid bias.

- Avoid making questions overly personal or uncomfortable for the participant.

- Don’t assume your audience has a high level of prior knowledge or experience in order to answer the question. At the very least, minimize what they need to know to have their opinion count.

Start sending one-click surveys today

Set up a beautiful one question survey today. Our free trial should give you plenty of opportunities to experiment with fast, effective feedback surveys within emails. We integrate with practically every platform and generate some of the best response rates in the business. Start your trial today.